The Potential of Local Currencies

By Diana Finch (Managing Director, Bristol Pay)

An introduction to local and complementary currencies

Money has not always been dominated by national currencies. For most of our history, money was something inherently local, often with more than one currency operating within a locality and with varying rates of exchange. Even in the modern era, complementary currencies continue to be invented and used.

Each complementary currency is designed to achieve something. Nectar points are designed to keep you shopping with specific retailers and manipulate your spending habits. But many currencies are designed with broader social and economic intentions.

One broad category of such currencies are unbacked currencies. These create a medium of exchange that is not dependent on having access to the mainstream currency. These often emerge at times of economic hardship, when people and businesses cannot get enough mainstream currency to meet their needs. A notable example would be Brazilian Palmas, first created in 2000. Mutual credit also falls into this category, with the most well known example globally being Sardex. Other examples are more focused on communities, such as the timebanking scheme in Japan that enables someone living a long way from elderly relatives to care for elderly people in their community, with the hours they’ve put in being reclaimed by their elderly relatives for their own care. In the 1970s, Michael Linton invented the idea of Local Economic Trading Systems (LETS), a concept that has formed the basis of many community currencies, through which people trade skills and goods without the need for money.

The other broad category of complementary currency are asset backed currencies. One set of examples are the town pound schemes that emerged first in Lewes and Totnes, which aimed to encourage the localisation of trade. The currencies are backed by (and equivalent to) Sterling, but have extra rules through which they aim to encourage behaviours that will favour local businesses, and therefore, local communities. Others are developing crypto currencies backed by natural assets such as trees, with the aim of including those assets within the economic system that usually only values them when they have been turned into timber.

Many of the things we take for granted about how money works are also challenged by these complementary currencies. We are used to the idea of the money we store growing through interest. Local currencies make no such assumptions: the Austrian Wörgl, which operated in the 1930s, worked in the opposite way. Demurrage ensured that it only retained its full value if spent quickly, keeping money actively flowing in the community and facilitating rapid economic growth.

The rise and fall of the Bristol Pound

The Bristol Pound was a backed local currency that operated in Bristol, UK from 2012 to 2020. Its operational focus was to encourage localisation: people would change Sterling at the rate of 1:1 into Bristol Pounds (either as digital money or as paper vouchers), which could then be spent with participating businesses. The only businesses that could set up Bristol Pound digital accounts were local independent businesses. Unlike a simple consumer-focused ‘shop local’ scheme, Bristol Pounds would remain in the system through ongoing business to business trade. Local businesses would benefit and grow, creating more jobs for local people. As the currency did not attract interest, Bristol Pounds would be spent rather than hoarded. This would create a local multiplier effect, with each Bristol Pound enabling more trade per annum than a Sterling pound.

The Bristol Pound grew fast: within the first three years it boasted 1,500 individual members and 650 business members. Over a million Bristol Pounds were transacted per year. Everything was set for Bristol Pound to be self-financing from transaction charges in the near future.

However, at around this time the growth stalled, and the following three years saw a gradual decline. Individual members tended to use the currency less, and businesses started to leave the scheme. As a result, the currency remained reliant on grants for funding, which became increasingly difficult to attract. By 2019, it was clear that the organisation needed to find a new model for its economic experimentation.

As part of designing what should come next, there was a need to look critically at the Bristol Pound. Why had it faltered just at the point that it was gaining worldwide attention? There were three main areas of learning: marketing; regulatory and technical issues; and business behaviour changes.

Marketing

The original marketing position of the Bristol Pound focused on its lofty aims of creating a fairer, greener and stronger local economy. The call to action was for people and businesses to join in this worthy movement. The message appealed to a demographic that was already aware of the damage being done to local producers and the environment by shopping at supermarkets, who were concerned about the increasing homogeneity of the high street, and who saw increasing inequality as a side effect of global business. They already shopped at local shops, and embraced the new currency.

However, this marketing didn’t create mass appeal. Most people expected a reward for changing their shopping habits and couldn’t see the point in joining. As a result, businesses didn’t experience the expected increased footfall.

Regulatory and technical issues

Back in 2010, when the Bristol Pound was being designed, Electronic Money Institution (EMI) regulation did not exist. If you wanted to have digital payments, you had to be regulated like a bank or credit union. This meant there had to be two sides to the digital Bristol Pound operation: a closed loop member to member payment side, and a regulated back end provided in Bristol Pound’s case by Bristol Credit Union.

Keeping these two sides operational proved to be costly. The tech was also clunky, whilst newer forms of payment became increasingly frictionless.

Business behaviour changes

As a Bristol Pound business, there were several hurdles. First, you would have to train your staff on how to process the paper vouchers and the digital Bristol Pounds. Second, you would have to add in complexity to your bookkeeping systems. Third, and it should be noted that this was the whole point from Bristol Pound CIC’s perspective, you’d have to find some suppliers that you could spend your Bristol Pounds with.

It had been assumed that having money in Bristol Pounds to spend would be the driver for participating businesses to change their supply chains. However, whilst a few business members did embrace this, many did not. Their Bristol Pounds remained as unspent balances or were converted back to Sterling.

Why was the assumption so wrong? For businesses producing goods, the supply chain is about far more important things than the currency you pay with. It’s about cost, availability, and perhaps the quality and provenance of the things you are buying. It’s also about forming trusted relationships with suppliers. You mess with your supply chain at your peril.

The new idea – Bristol Pay

With these learnings in mind, in 2019 work started on designing something that could follow on from Bristol Pound. The new scheme needed to appeal to a wider audience with an easier value proposition than economic systems change. It needed to be in line with current user experience expectations. It needed to be less reliant on independent businesses being prepared to change their supply chains. But it still had to be innovative. And most importantly, it had to be in line with our organisational aims of creating a greener, fairer and stronger local economy.

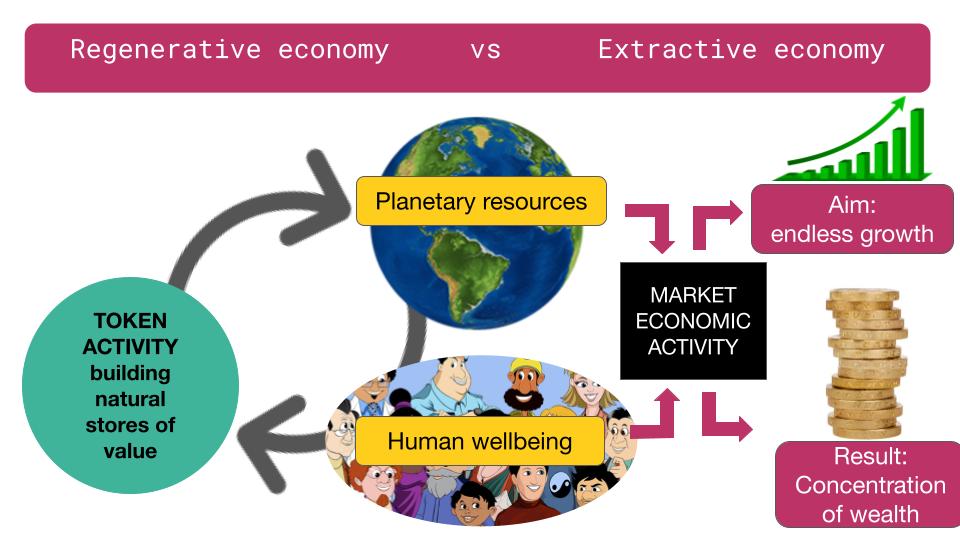

In Bristol Pound, it was the money itself that was designed to deliver impact. The new idea was to separate out the main way of delivering impact from the basic financial operation. The payment platform could operate at scale and generate income, but on that platform we could run a separate token operation that would deliver the social and environmental impacts core to our mission.

Bristol Pay will be EMI regulated. It will be a closed loop system, such that member to member payments are not processed by external operators such as VISA and Mastercard (who enable the open network behind most point of sale digital and e-commerce payments) or Pay.UK (which operates the faster payments infrastructure). As a result, member to member payments will be very cheap to process. By operating at scale and at normal market rates, the operation will generate funding for local charitable and social enterprise projects to improve financial inclusion and regenerate the environment. This then forms the value proposition: use Bristol Pay because it is raising funds that will address problems right here in Bristol.

The tokens are the really experimental part. There will be two main types of tokens – those that can be exchanged (i.e. ‘earned’ and ‘spent’ or passed on) and those that are a store of value (i.e. that can be ‘earned’ and maintained). We are used to money, which combines these functions, but tokens offer us a chance to split these functions out.

Exchangeable tokens

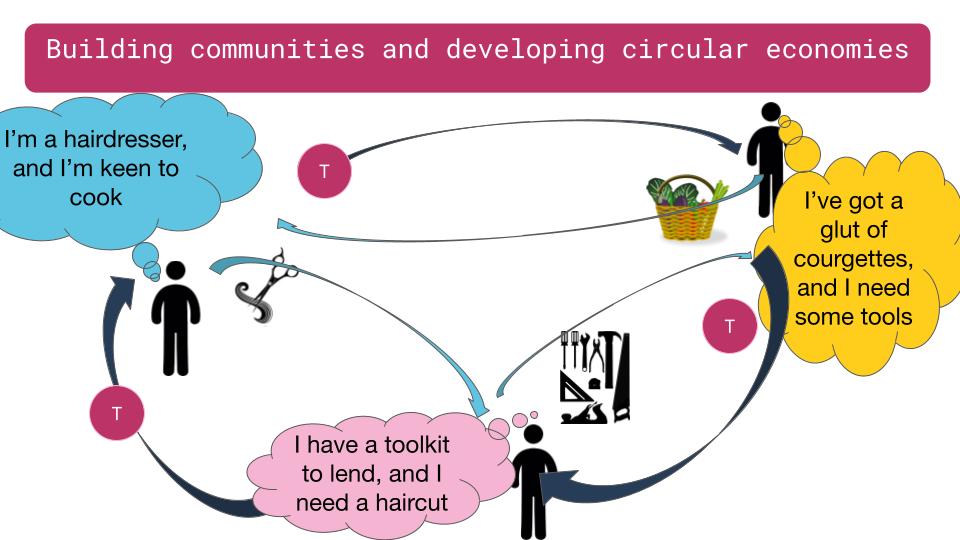

Exchangeable tokens are like the traditional local currencies that existed before the ‘town pound’ schemes of the 2000s. LETS, timebanking and baby-sitting circles fall into this category. These schemes tend to have similar aims, such as enabling community members to share skills and resources regardless of financial means, and building community cohesion. On the whole, they have achieved positive outcomes, but only in very limited geographical areas, and for limited periods of time. The reason for these limitations is that they are reliant on a host of local volunteers to promote and administer each scheme. By offering a token infrastructure on the new platform, such schemes can be opened up to all members of the platform, across a whole city, and with no need for volunteers to administer or promote the scheme.

We see these schemes as particularly important at the current time. In 2021 we are likely to see the highest number of people not in employment (or under-employed) for many years. Poverty is likely to increase. Public services are likely to be increasingly stretched. There is a real need for communities to come together to meet their own needs, but there needs to be an economic mechanism to enable that to happen. Exchangeable tokens on a platform can provide just such a mechanism.

On top of this, we need to reduce carbon emissions globally. Whilst local governments focus on scope one and scope two emissions (broadly speaking, transportation and power consumption in the built environment), there is less work on scope three emissions, which are basically the emissions associated with all the things we buy from elsewhere. Scope three emissions are arguably still caused by us: it is our demand for these products that causes the emissions. To lessen our scope three emissions, we need to buy less. We need to maximise the usefulness of each thing that is bought. It is better for the environment if 20 people borrow one person’s power drill, than if all 20 go and buy their own power drill. It is better for the environment if I swap my clothes that no longer fit or match my style for other clothes that no longer meet someone else’s needs, than if we all go and buy new clothes. We could reduce not only our scope three emissions, but also the amount of waste going to landfill through this kind of currency.

Store of value tokens

We can perhaps best think of store of value tokens as a qualification. A qualification tells someone that we are able to undertake a specific task. That ability doesn’t diminish as we do more of that task – indeed arguably it gets better. Indeed it is if we stop doing it that we might need to take an additional qualification to top up our skill level again. This is precisely how we see store of value tokens working. They can be awarded for specific actions, and kept current by continuing to do those actions, but may erode if we stop doing those things.

To address the climate emergency, we need to change our behaviours. We all know this, and yet surprisingly few of us actually follow through. It’s not surprising: we are constantly bombarded with advertisements, social media content and entertainment telling us that we will be happier if we buy more stuff, or travel to exotic locations. Then we perpetuate the narrative with our own rose-tinted posts. Giving up flying is seen as a privation. Going green is portrayed as stoically giving up anything fun. Those delivering the message that we should change our ways are seen as finger waggers seeking to limit our autonomy and freedom. We are also repeatedly told that in any case such efforts are pointless: until China or the USA change their ways, what is the point of me doing anything?

How can we build a society where the positives of changing our ways are celebrated; where we can see the overall impact of all the little changes we make; where our reputation is enhanced by doing the opposite of the stuff we boast about on social media? This is the role of the store of value tokens.

Such things have been tried before. But usually they have suffered from the same problem as Bristol Pound: only those people who are already serious about the issue take the time to set up an account. By putting the tokens onto an app that many people will be using daily anyway, more people will interact with the tokens.

What sort of behaviours will be encouraged? There are so many potential uses that it is hard to predict. There might be one scheme to encourage carrying reusable drinks containers (to limit litter and single use plastic use), another to encourage cycling, another to encourage people to help vulnerable neighbours, another to volunteer for community organisations.

What will tokens do for people? Many have assumed that the tokens will drive discounts or financial rewards. But we know from research around the world that financial rewards do not change behaviours in the longer term. Indeed, they have been shown to decrease intrinsic motivation to behave in specific ways. What can work is raising money for some other cause (such as collecting aluminium foil in the 1970s for Guide Dogs for the Blind), or inclusion in a lottery (such as the Yeoken scheme run by Yeo Valley).

But not all tokens need to be linked to money. This is where we have some positive things to learn from other tech industries. From gamified learning apps like Duolingo, we can learn how to encourage people to engage every day by recognising all their efforts with points and levels. From social media we can see that people care about their social reputation. From trading platforms like Uber, we can learn about how important it is to have a good rating to build trust. By building on these techniques, along with an understanding of what does encourage behaviour change (normalisation, visibility of effects, and feeling part of a tribe, for example), we can build token schemes that engage people and build intrinsic motivation to change behaviour.

This isn’t just about individuals. One of the first token schemes we’re working on is for businesses. In collaboration with University of Bath, we’re developing a series of badges so that people using Bristol Pay will be able to see which businesses are committed to addressing inequality by paying the real living wage, which are focused on their environmental impact, and which are choosing suppliers on the basis of social and environmental performance rather than just cost. This might well determine your spending habits, and that in turn would encourage businesses to try to achieve more badges. Meanwhile, at a city level, monitoring business badge achievements will provide an early indicator of businesses’ progress towards developing an economy that is greener and fairer.

Summary

Bristol Pay will build on from where Bristol Pound left off, creating a greener, fairer and stronger local economy through highly innovative systemic interventions. It will operate at scale, and will be designed to engage people and businesses in far wider changes than merely purchasing locally, by combining money and tokens on one platform. Most importantly, once we have proved the model in Bristol, this approach can be implemented elsewhere, to create impact on a global scale.